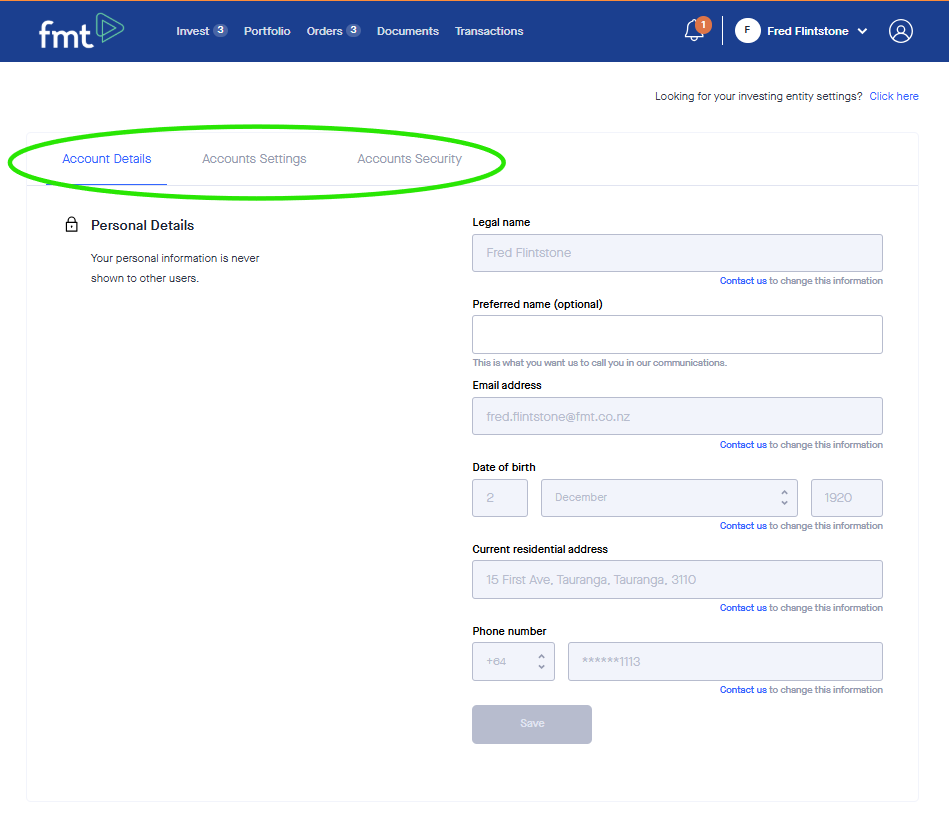

Many of the account details fields are locked after the account is set up. The fields in white, (in this case preferred name), can be edited.

For security purposes, we need you to contact us if you wish to change the greyed-out details, like your email address or contact phone number.

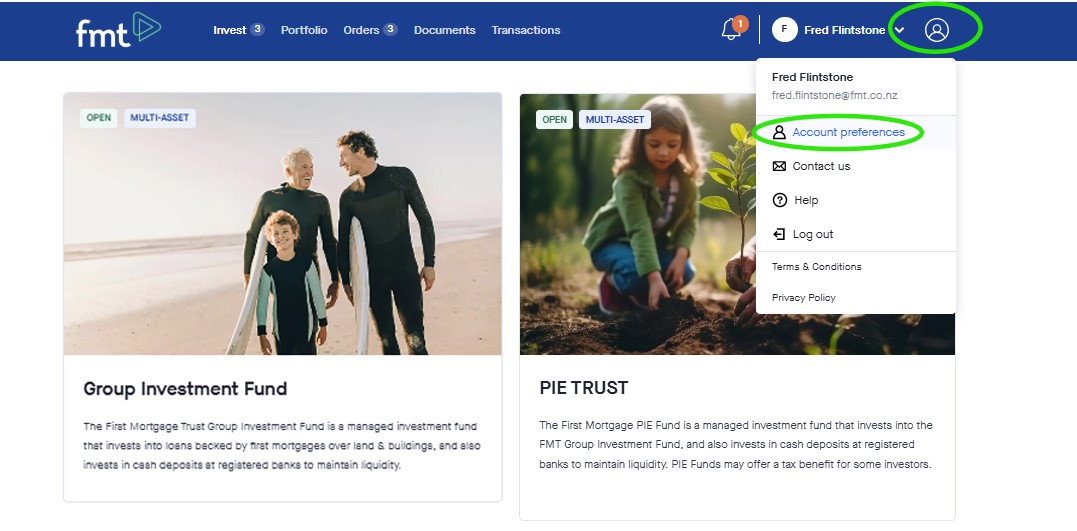

You can click the tabs at the top of the page to view and update different things.

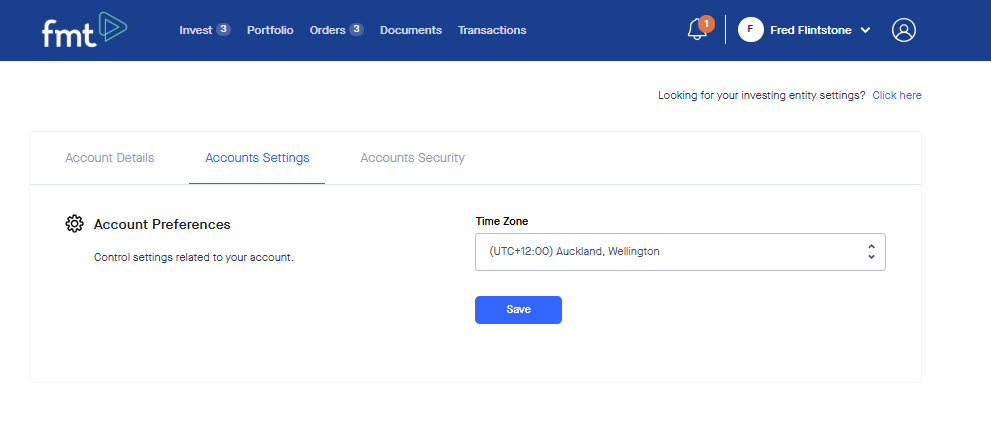

You can edit your time zone under the Account Settings tab

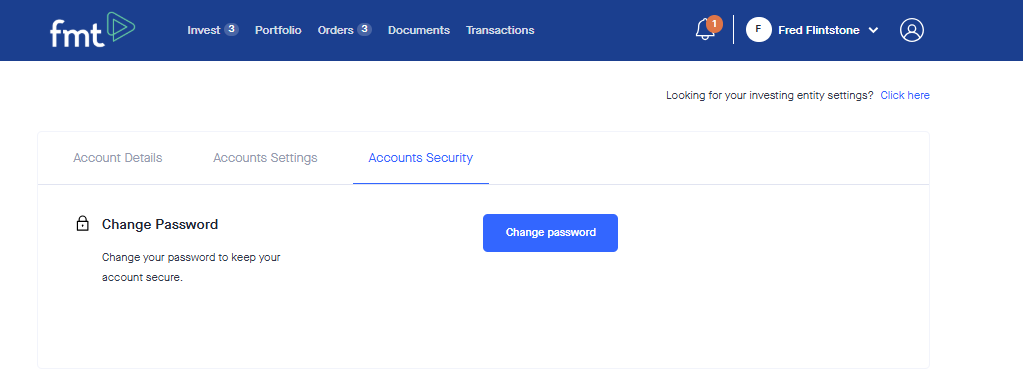

You can change your account password under the Account security tab

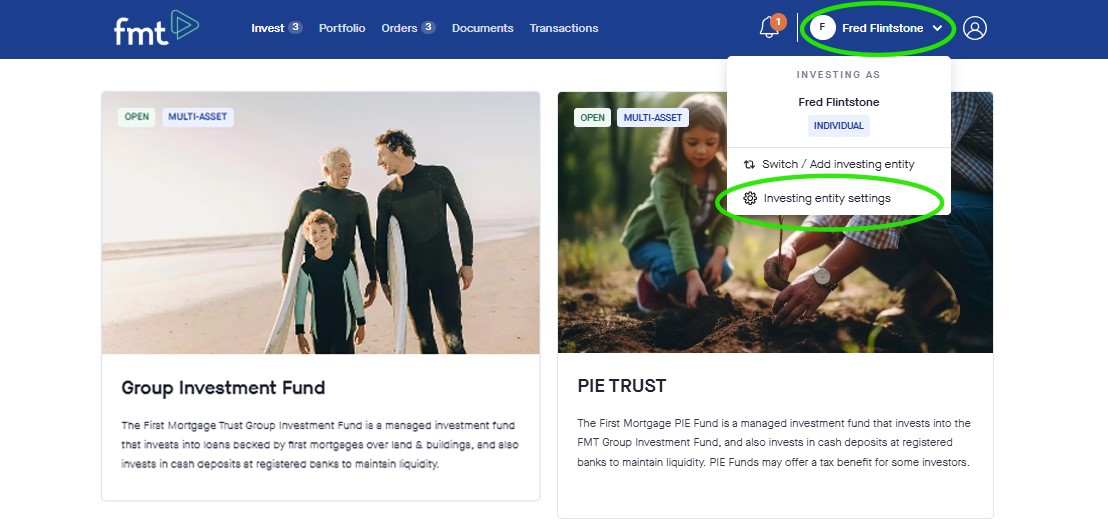

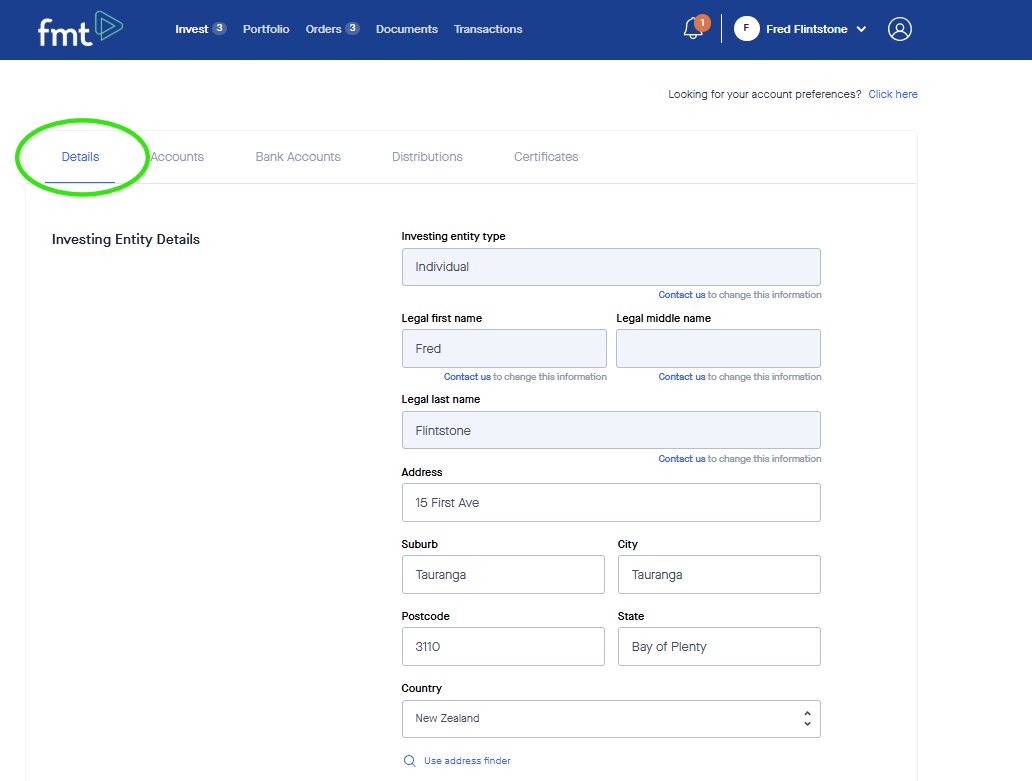

As with account level details you can navigate through the entity details by clicking on the tabs at the top of the page.

Some of the entity details fields are locked after the entity is set up. The fields in white, (in this case preferred name), can be edited.

For security purposes, we need you to contact us if you wish to change the greyed-out details, like the entity type or legal name.

You can edit address, tax details & the nature and purpose of your investment here.

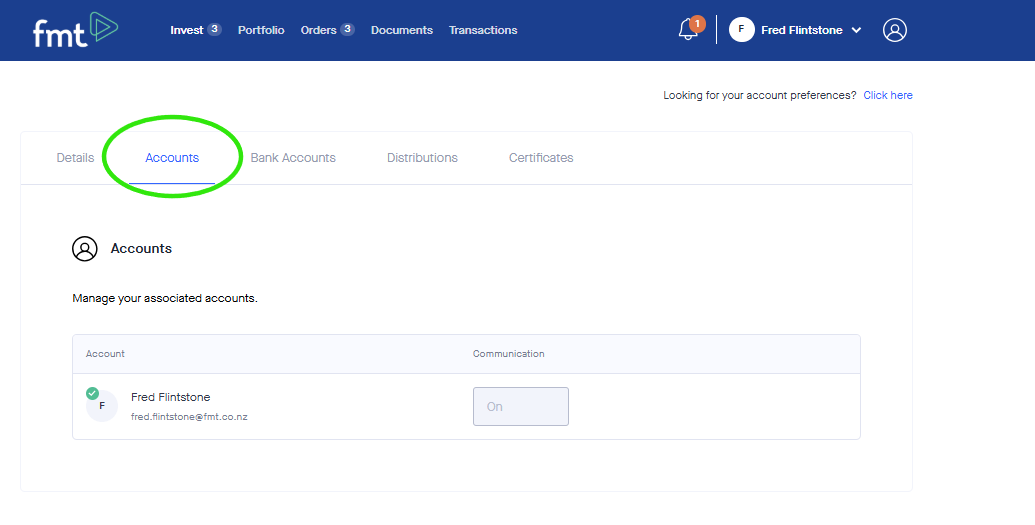

You can manage associated accounts and communication settings for the investing entity on the second tab.

Note: If you are the primary account holder, communication settings must remain enabled.

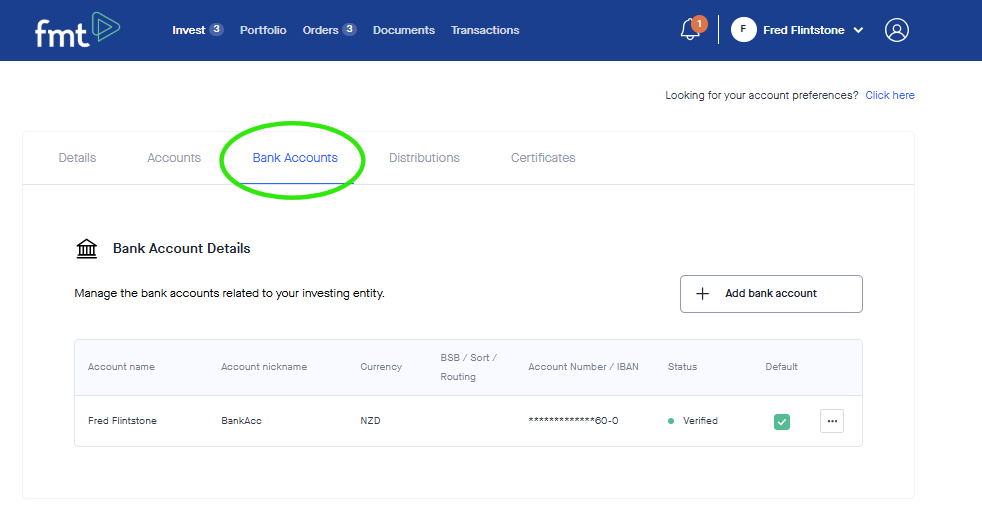

You can edit and add bank accounts associated with the investing entity in the “Bank Accounts” tab.

You will need to upload supporting documents to confirm these details – see the Adding a bank account guide for details.

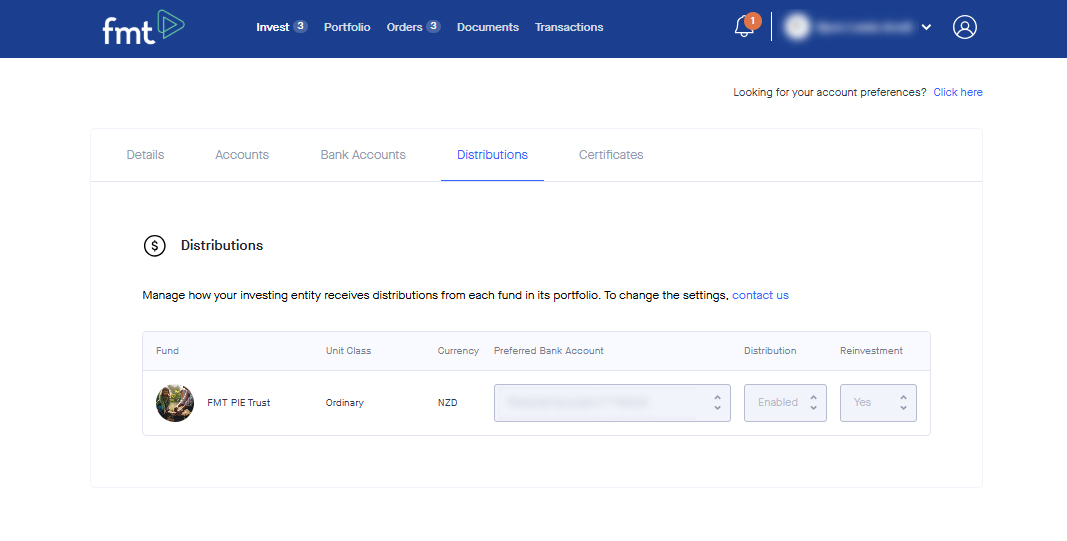

You can view how you’ve chosen to receive distributions from each fund you’re invested in.

If you would like to change your distribution settings, please contact us on 0800 321 113 or use the contact form below.

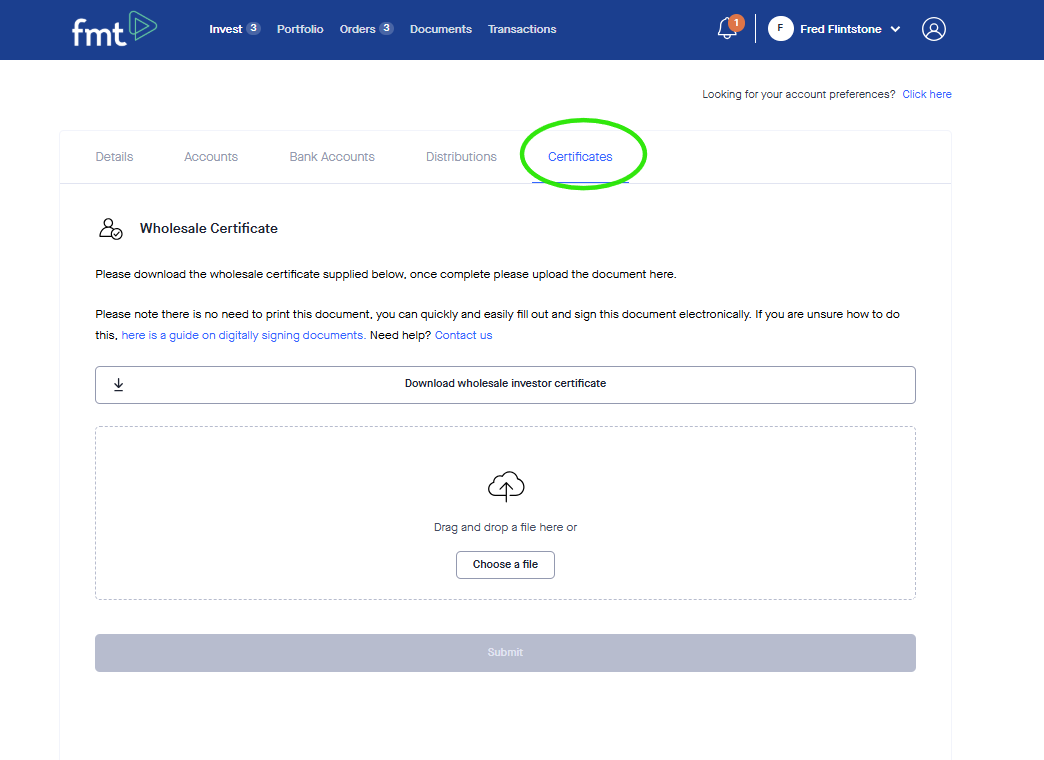

If you are a wholesale investor & are planning to invest in our wholesale fund, you will need to upload supporting documentation in the “Certificates” tab of the investing entity settings.

Contact the team on 0800 321 113 or fill out the form below.

One of the Investment team will get in touch as soon as possible.

Complete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.