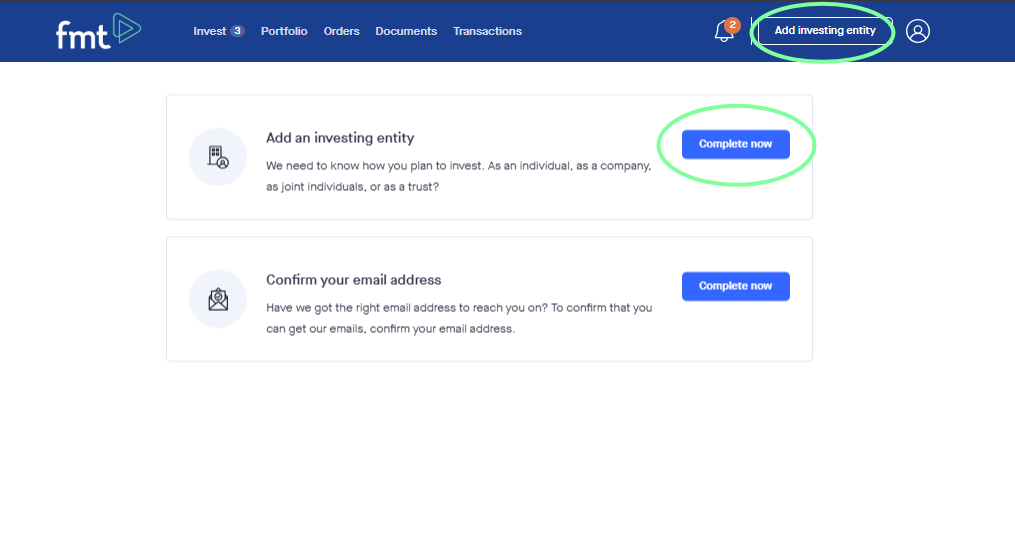

Then click “Add investing entity” on the top right of the page.

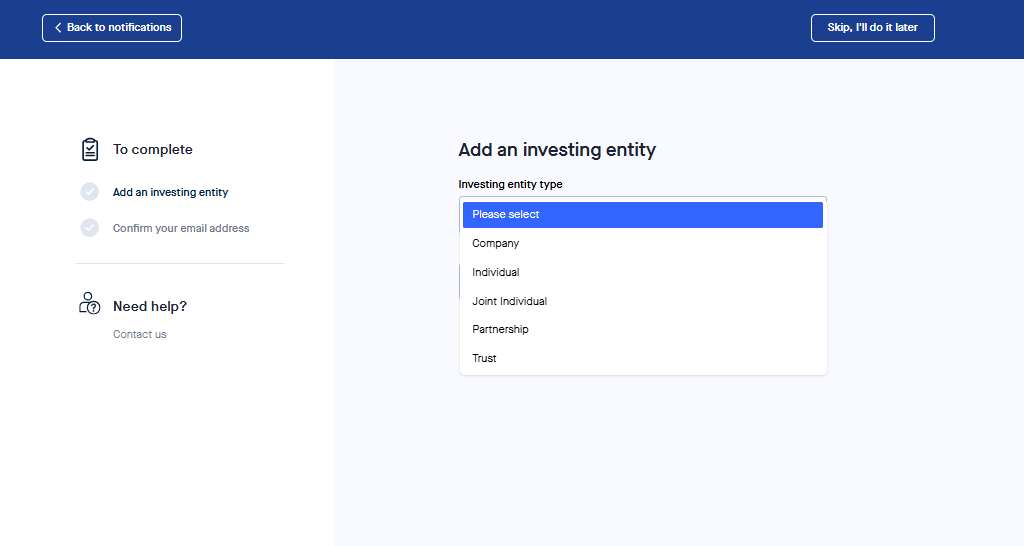

Your options are individual, joint individual, partnership, company or trust.

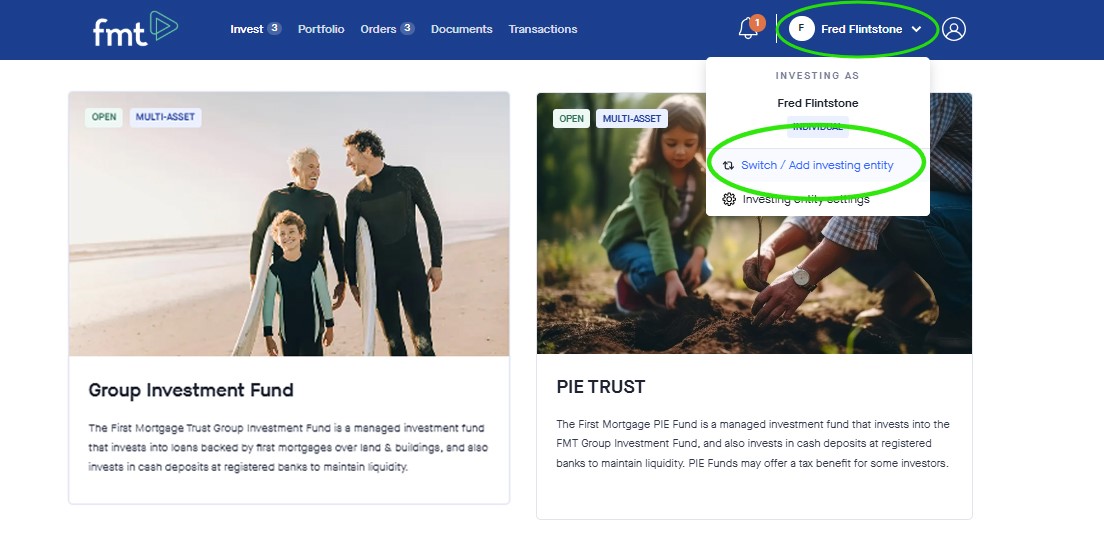

You can have multiple investing entities set up, and you’ll need to go through this process for each of them.

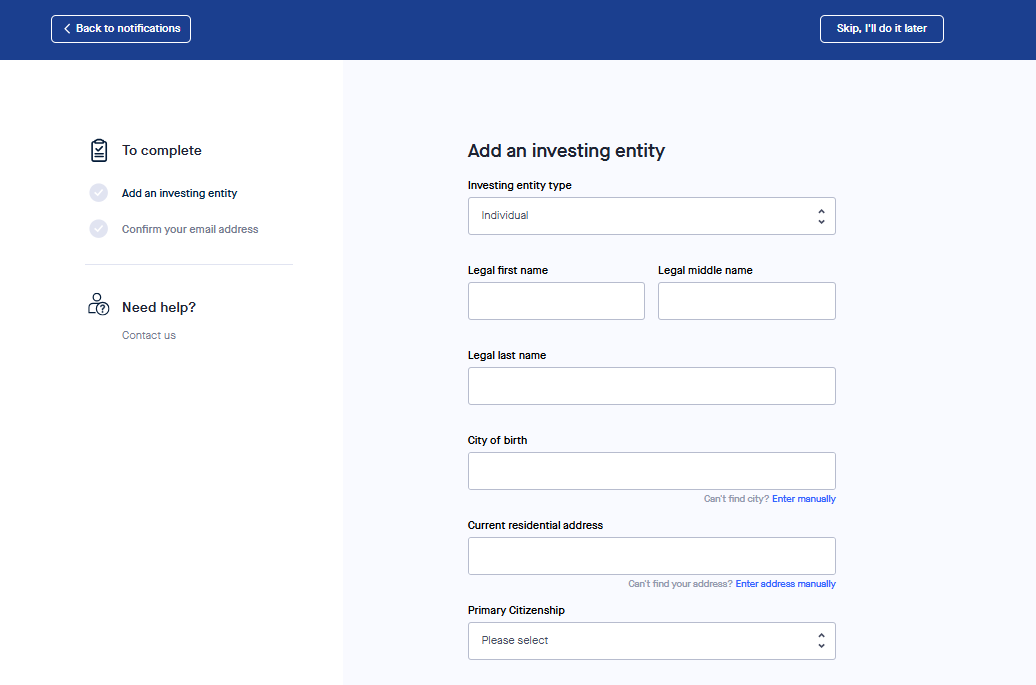

Here we chose an individual investing entity; the investing entity type you choose will decide which information we need you to provide to set up the entity.

Fill out all the fields. Some of these, like tax rate, can be edited later.

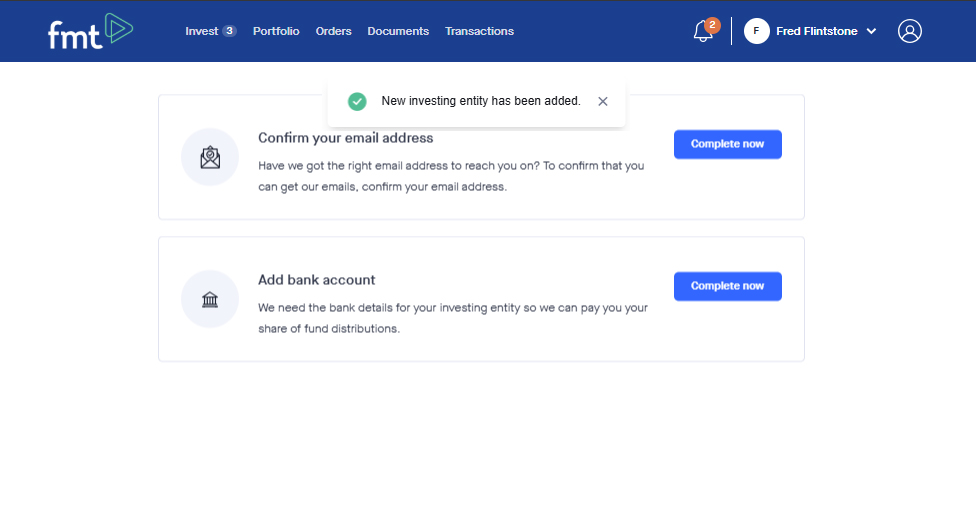

To invest with this entity, you will need to complete the final few steps:

If you have any issue with this process, please use the form below to contact one of our team or give us a call on 0800 321 113

Contact the team on 0800 321 113 or fill out the form below.

One of the Investment team will get in touch as soon as possible.

Complete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.