We are very proud to be a sponsor of the Save the Kiwi, the national charity working to ensure the survival of our most iconic bird.

Kiwis are our national icon and entwined with our identity as New Zealanders. The vision for Save the Kiwi is to see kiwi go from endangered to everywhere. They work with community-led kiwi conservation groups, iwi, DOC, landowners, businesses and Kiwis across the country to increase kiwi populations by 2% per year.

If you would like to find out more visit savethekiwi.nz

The Coastguard is a charity which does an impressive job keeping people safe on the water. We have partnered with the Tauranga Volunteer Coastguard for five years, the last four as their premier sponsor.

The Coastguard are always on the lookout for volunteers – see their website coastguard.co.nz for contact details.

Since 1999, Hanmer Clinic in Tauranga has been at the forefront of providing alcohol and drug addiction treatment services in the Bay of Plenty. Their approach extends beyond addiction treatment; encompassing a holistic view of individual wellness, integrating the strengths of the person and their family into the recovery process.

The value of Hanmer Clinic’s work is echoed in the heartfelt testimonials of those who have benefitted from their services. One client shared, “The treatment I have received from Hanmer Clinic has been life-changing,” while another reflected, “This programme and the team have helped me change my path on which I journey.”

To learn more visit hanmerclinic.co.nz

In 2024 we sponsored House of Science in their efforts to improve STEM education in New Zealand.

Here’s some of their 2024 highlights:

If you’d like to learn more visit houseofscience.nz

For almost 20 years we have offered an annual Youth Sponsorship grant. The Sponsorship is open to young people between the ages of 16 and 25 who are excelling in their chosen field at a national and/or international level in the fields of sport, music or the arts.

At FMT, it’s important for us to invest in the community we work and live in, and we want to help our next generation of stars!

Learn More

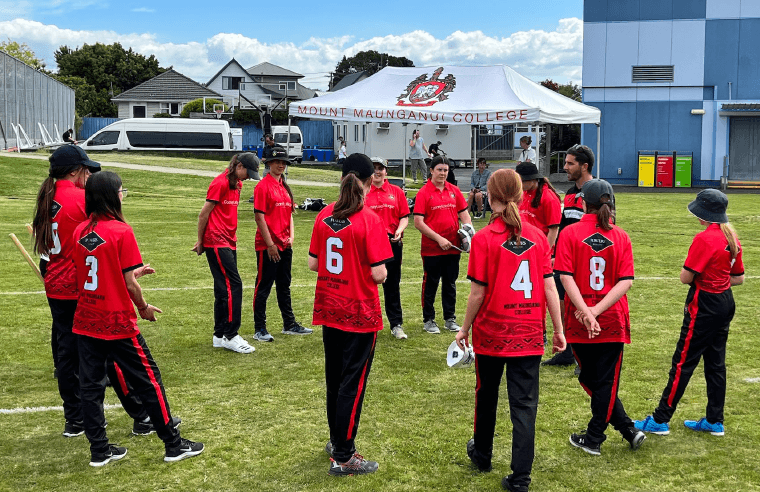

We have recently partnered with Mount Maunganui College cricket club. The sponsorship provided by First Mortgage Trust contributes to the cost of the cricket programme, with our funds targeted toward uniforms and equipment.

Great to be on board with you MMC!

Please note: Where sponsorship funds or donations are made by the Manager, these do not come out of investor funds.

Complete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.