For almost 20 years, FMT has proudly supported emerging talent through our annual Youth Sponsorship Programme. We believe in investing in the communities we live and work in, and we’re committed to helping the next generation of stars reach their full potential.

Our Youth Sponsorship is open to young emerging talent aged 16–25 who are excelling nationally or internationally in sport, music, or the arts. We’re looking for individuals who demonstrate ambition, resilience, and a drive for achievement — and who live the values we hold at FMT: Teamwork, Integrity, and Achievement.

We award two grants in each age group (16–19 and 20–25):

Successful recipients will be invited to share their journey with our investor community by providing a short video for our Investor Meetings and up to two written updates (300 words), along with photos, throughout their sponsorship period.

How to Apply

Applicants are required to complete an online application and provide:

We look forward to supporting the 2026 recipients as they continue to excel in their field. FMT is proud to play a part in helping young New Zealanders pursue their dreams.

Applications close 31 March 2026.

Apply Now

In 2025, FMT proudly awarded four Youth Sponsorship Grants to outstanding young New Zealanders achieving excellence in sport and the arts.

The 2025 recipients are Alyahna Sanson-Rejouis, a 17-year-old singer-songwriter and multi-instrumentalist; Ariel Muchirahondo, a record-breaking 17-year-old swimmer; Olive Pearce, a 23-year-old surf lifesaving and canoe sprint athlete studying medicine; and Hadley Beech, an elite inline speed skater and coach representing New Zealand internationally.

Each recipient exemplifies talent, resilience, and ambition — and FMT is proud to support them as they pursue their dreams.

Learn more about the 2025 recipients

Gabby is a T54 competitive wheelchair racer, who has spent over five years competing at the highest levels. Her journey after becoming paralysed in 2016, is a powerful story of resilience and success. She refused to let adversity slow her down, instead she’s used it to fuel her successes, both on and off the track.

Gabby has set multiple New Zealand records, competed internationally, and continues to push the boundaries of what’s possible, with her ultimate goal being to compete at the 2028 Paralympics in Los Angeles. Beyond athletics, she’s also channeling her passion for change into architecture, with a vision to revolutionize accessibility in modern design.

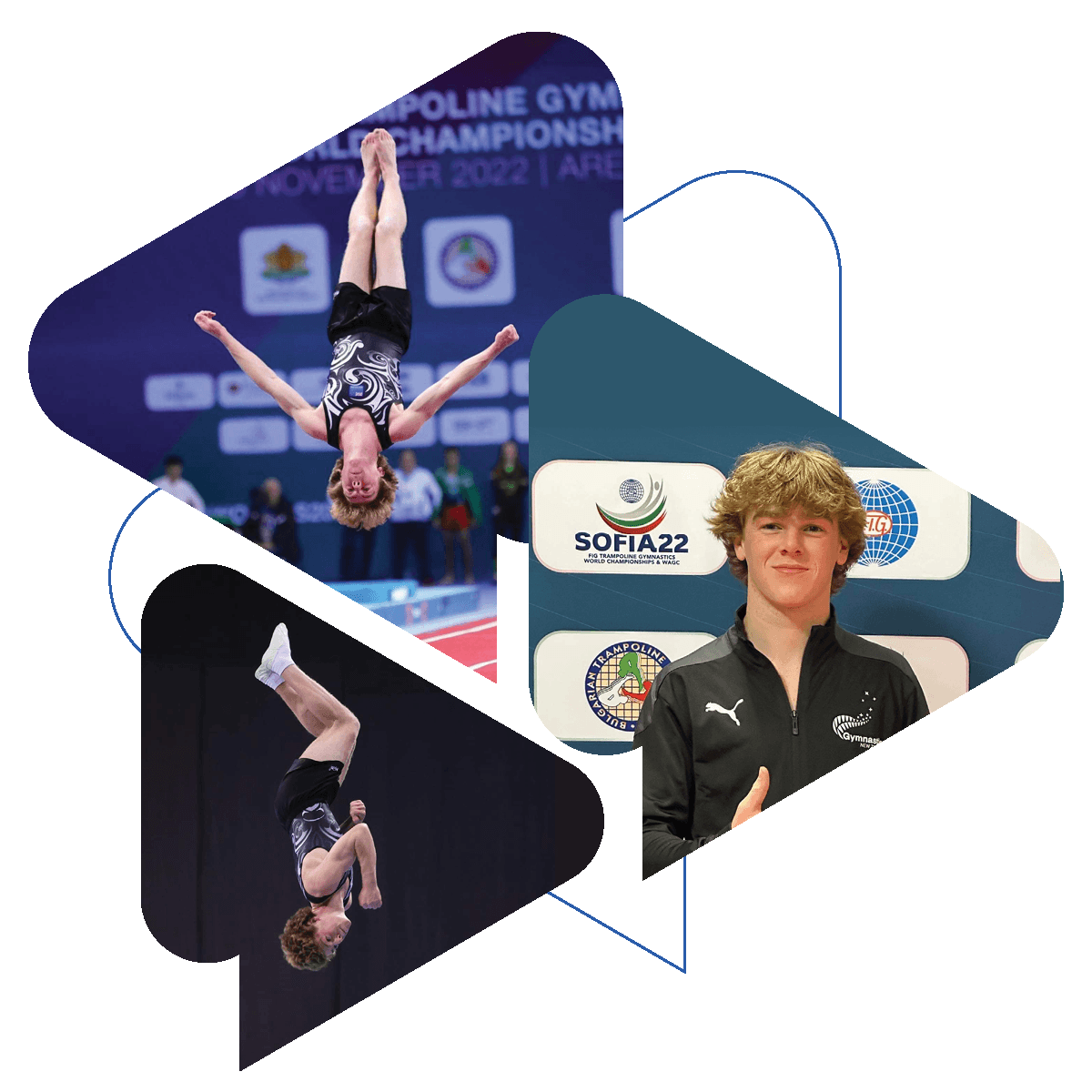

“It is an absolute honour to receive the FMT Youth Sponsorship for 2023. As my sport of Trampolining is fully self-funded, the sponsorship has been used to partially fund my recent trip to the World Age Group Trampoline Championships in Birmingham. There, I ended up placing 11th on the Trampoline and improved my personal best by a whole mark, a huge step towards my ambitions for future years.

The other half of the sponsorship is to be used to partially fund next year’s World Cup competitions in Portugal and Switzerland. My goal for the next four years, building up to the Los Angeles 2028 Olympic Games, is to improve my average score by a mark each year so that by the time the Olympic year comes around, I will be sitting in good contention to qualify for a spot to compete at the Games.

This has been possible because of all of you at FMT, so a big thank you for sponsoring me and funding my ambitions and goals.”

– Lachie Kirk

“It is an absolute honour to receive the FMT Youth Sponsorship for 2022. The sponsorship will help to fund my swimming events and ambitions over the next 12 months. In December, I hope to complete the longest ever attempted, surf rescue solo swim event from Motiti Island to Pukehina surfclub which spans 20 km.

In January, I am off to the French Alps to represent NZ competing in the World Ice swimming championships. This is the first time a NZ team has been selected to compete in this event.

I am looking forward to swimming for NZ and promoting ice swimming for all New Zealanders.

A huge thank you to FMT for giving me this funding and helping me achieve my goals.”

– Quinn Boyle

Complete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.