Investing in the FMT GIF or PIE Trust:

Investing in the FMT Wholesale Fund:

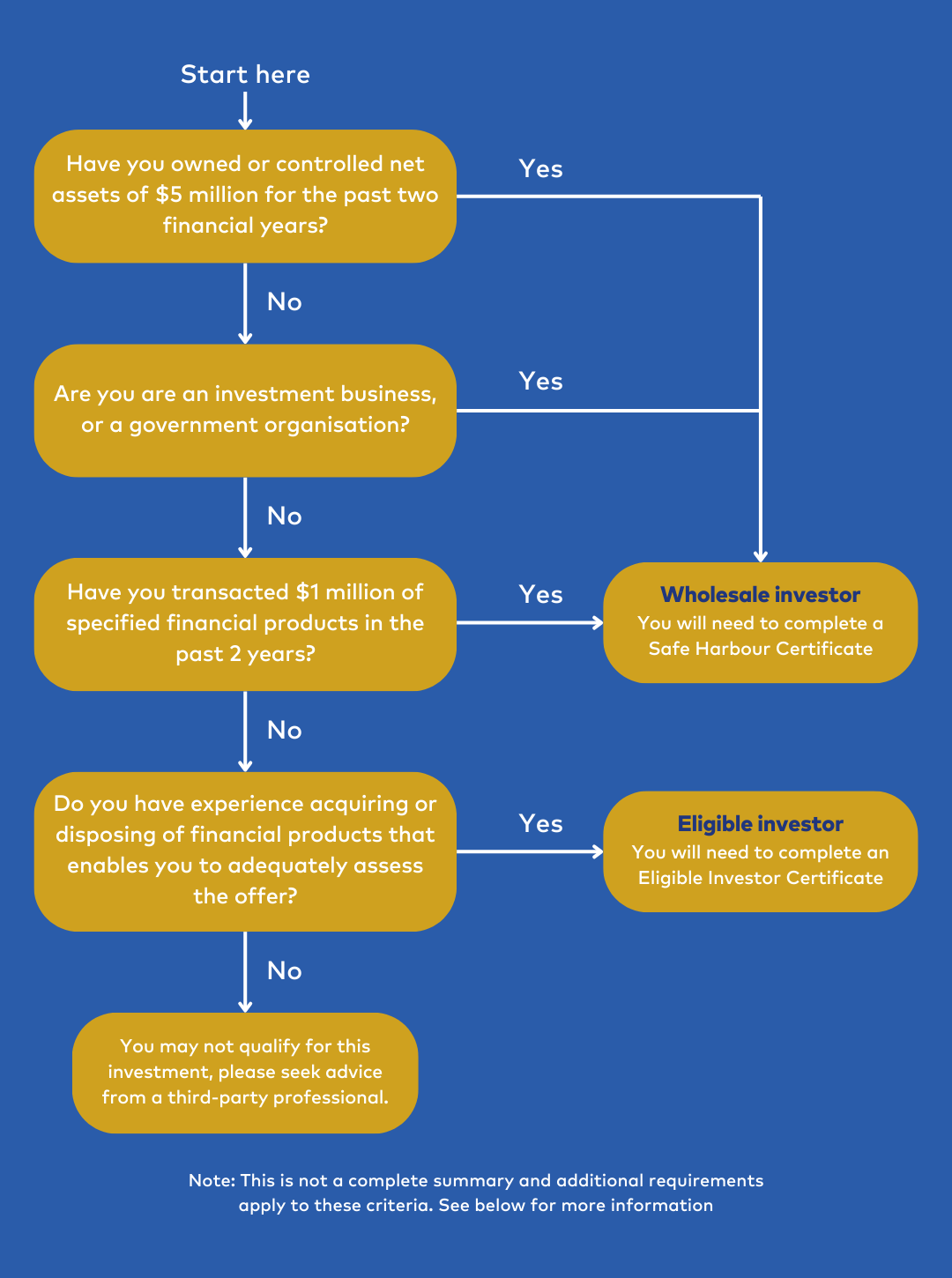

Wondering if you qualify as a wholesale investor for the purposes of the FMT Wholesale Fund?

Please use this flow chart to help inform your decision.

There are a number of ways that you can qualify as a wholesale investor, for example:

This is not a complete summary of wholesale investor requirements. Further details on the requirements to fall within each of these wholesale investor categories, and other wholesale investor categories, are set out in the Safe Harbour Certificate available from us. If you believe you qualify under one of these categories, you’ll need to complete a Safe Harbour Certificate alongside your application form.

You may also qualify if you have experience acquiring or disposing of financial products that enables you to adequately assess the offer.

This means you would need to provide an Eligible Investor Certificate as well as a written confirmation from a third-party professional to certify that you understand the consequences of the certification.

This professional could be a financial adviser, a qualified statutory accountant or a lawyer.

If you believe you qualify under this exemption, please consult a professional to ensure you understand the implications of investing in the FMT Wholesale Fund before applying.

No PDS is required to be made available for the FMT Wholesale Fund, however an Investment Memorandum is available on expression of interest.

Disclaimer: This information is of a general nature and is not financial advice. We strongly recommend that you talk to your financial adviser to determine if investing in the FMT Wholesale Fund is right for you. We do not provide financial advice.

Please fill out the form below and one of our investment team members will reach out soon to discuss this opportunity further.

Complete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.