Mortgage trusts are one of the oldest examples of a collective investment scheme. Under this model, investor funds are pooled together in a trust, with delegated authority given to a management company (in FMT’s case First Mortgage Managers Limited) who oversee the trust and select suitable lending opportunities in accordance with the ruling trust deed.

The manager of the Fund is First Mortgage Managers Limited (FMML ).

FMML was established in early 1996 with the primary purpose to establish a vehicle by which investors could invest

money for an interest return greater than that of a trading bank’s term deposit rate.

The sole business of FMML is to act as manager of the First Mortgage Trust Group Investment Fund, the First Mortgage PIE Trust and First Mortgage Trust Wholesale Fund.

FMML has built a niche market focused on its ability to remain flexible within its lending criteria. This flexibility has

enabled us to make first mortgage loan advances to a wide range of borrowers.

All investments involve risk.

With any investment there is a chance the return may be different from what is expected. The key to our success has been the first-mortgage investment security we require when lending (via first mortgages on New Zealand land and buildings with relatively conservative loan to valuation ratios). This is further supported by the lending process we have elected to have in place before any investor funds can be placed with borrowers.

What this means is; our internal team assess and recommend loans for approval; then our independent credit team make the decision on whether to proceed with the loan.

Our appointed supervisors add another layer of oversight, providing our investors with confidence that their money is in good hands and only being invested in accordance with the Trust Deed.

For more information on risk, please refer to the Product Disclosure Statements.

The Fund charges are estimated at 1.65% of the Fund value including gst. This is subject to change.

We also reserve the right to charge a withdrawal fee of 2% of the amount withdrawn during the first year of investment and 1% of the amount withdrawn during the second year of investment. There is no withdrawal fee for investors who withdraw after their second year of investment.

There are no upfront fees when you invest with First Mortgage Trust. At the end of each quarter, the rate of return we declare is net of all fund charges and expenses, so what you see on our statements is what you’ll get delivered directly into your account (other than amounts deducted to pay tax).

Distributions (being the income earned on the Fund’s investments after the payment of tax, fees, expenses & reserve fund contributions) are calculated quarterly at the end of March, June, September and December in each year.

Our usual practice is to pay the distributions to investors on the third business day after the end of each of those months (though this may take longer in limited circumstances).

What you see on your statements is what you’ll get delivered directly into your account (other than amounts deducted to pay tax).

To withdraw your funds from a First Mortgage Trust Fund you must complete a Notice of Redemption.

Withdrawals are normally actioned twice a week (on Monday and Thursday). We generally action withdrawals within four business days of receiving your completed Notice of Redemption.

A Notice of Redemption must be for at least 500 units or the whole amount of your investment if less than 500 units.

You need to be aware that in certain circumstances withdrawals could be suspended or deferred.

Investments (allocations) in the Fund must be at least $500 on joining. Subsequent investments (allocations) in the Fund must be at least $100.

When depositing new funds and additional funds you will require our bank account details and your investment number. All you need to do is go into your internet banking and go to Payees and type in First Mortgage Trust. This will populate our account details for both the PIE Trust and the Group Investment Fund. If your investment number starts with a “D” this is the Group Investment Fund, and if your investment number begins with a “P” this is the PIE Trust. Then you choose the appropriate account and use your investment number as the reference number.

We may ask you to provide information to support your deposit – this helps us comply with our legislative requirements under the Anti-Money Laundering & Countering Financing of Terrorism Act 2009 (AML/CFT Act).

Distributions (being the income earned on the Fund’s investments after the payment of tax, fees, expenses and reserve fund contributions) are calculated quarterly at the end of March, June, September and December in each year. Our usual practice is to pay the distributions to investors on the 3 business day of next quarter. This may take longer in limited circumstances.

You can elect to re-invest your distributions in the Fund. If your distribution in a quarter is less than $25 we can choose to re-invest your distribution in the Fund.

Your investment is not locked in for a specific amount of time. We do encourage investors to invest for a minimum of two years. This is because mortgage lending terms are generally 18 months to 2 years, so this timeframe is generally aligned to the Fund’s underlying investments. Also, no withdrawals fees are payable on withdrawals after two years from investment.

You need to be aware that in certain circumstances withdrawals could be suspended or deferred.

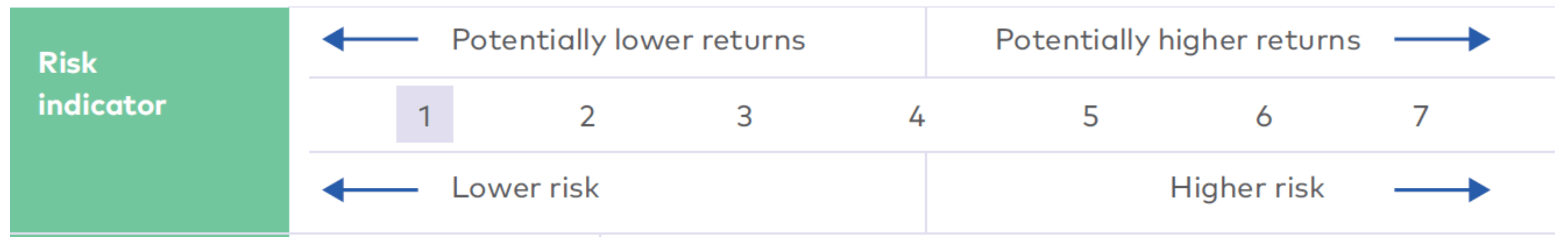

Managed funds in New Zealand must have a standard risk indicator. The risk indicator is designed to help investors understand the uncertainties both for loss and growth that may affect their investment. You can compare funds using the risk indicator.

FMT’s Funds currently have a risk indicator of 1. A risk indicator of 1 does not mean a risk free investment. For more information, please refer to the Fund’s Product Disclosure Statements.

No, even through the Global Financial Crisis and the COVID-19 pandemic we have never lost investor capital. We believe this is due to our conservative investment strategy and our prudent lending approach.

However, past performance in not a reliable indicator of future performance and there can be no assurance investor capital will not be lost in the future.

Your money will be pooled with other investors’ money. First Mortgage Trust will invest your money into loans backed by first mortgages over land and buildings and in cash deposits at registered banks. The investment objective is to provide investors with an income return at a level better than bank deposits.

In addition, while it cannot be assured, we aim to provide a pre-tax return (after fees and expenses) of at least 1% higher than the average 12 month term deposit rate offered by the four main trading banks and competitive with comparable investments.

The returns you receive are dependent on the investment decisions of First Mortgage Managers Limited and the performance of the investments. Our Product Disclosure Statements outline this in more detail.

The Group Investment Fund and the PIE Trust provide the same investment exposure, as the PIE Trust invests solely into the Group Investment Fund.

However, what is different is how your tax is treated. If you have a 30% or higher income tax rate, the PIE Trust could give you a higher after-tax return than the Group Investment Fund.

We recommend you seek independent advice on which fund is best for you, as our team can only provide information about the funds, not personal advice on how you should invest given your circumstances.

In return for your investment you receive units in the Fund.

The value of the units in the Fund is based on the market value of the Fund at the relevant time. The value of new units is based on the value of the Fund on the business day before your application for units is received. The value of the Fund is, in summary, the value of deposits with banks and the market value of the loans, less liabilities including undistributed income and the reserve fund value.

We aim to maintain the unit price at $1.00 on an on-going basis. However, the unit price may go up or down because of changes in market conditions and other factors.

The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (AML/CFT Act) is designed to help detect and deter money laundering and terrorism financing.

We must comply with the AML/CFT Act, which helps protect our communities from criminal activity. This means that we need to collect and verify information about you, such as your identity, address, nature and purpose of the business relationship, and sometimes your source of funds and wealth.

Biometrics is facial recognition technology – we use it to biometrically match your face to the picture on your ID. In order for us to do this you will be sent a link via a text message.

Using a mobile device you will be asked to:

We think facial recognition is the fastest and easiest way for you to confirm your identity and for us to identify you. But we do have other options available if you are not comfortable using the biometrics technology, or you don’t have a smartphone.

We can accept certified copies of identification and other documents we need to collect, or you can contact us to discuss your options.

Under our Trust Deed and SIPO, First Mortgage Trust can only lend on first mortgages secured over land and buildings and other similar investments (which means we do not lend on consumer goods such as appliances, used cars etc).

The Trust Deed and SIPO contain various other rules we must comply with.

Investors own units in First Mortgage Trust Group Investment Fund or the First Mortgage PIE Trust, and the activities of those Funds are managed by a manager (First Mortgage Managers Limited) on behalf of the investors.

The manager takes care of the investment income, facilitates lending in line with the Trust Deed and SIPO, liaises with the supervisors and custodians, and ensures compliance with the Trust Deed. For this service, an agreed fee (of approximately 1.5% of the Fund value) is charged to the Fund for management services. Expenses are also charged to the Funds.

One of the factors that we consider before we approve a mortgage is the LVR or ‘loan to valuation ratio’. This is the loan amount expressed as a percentage of either the purchase price or the appraised value of the property. The lower the Loan to Valuation Ratio, the better from a lender’s risk perspective. Loan stats including LVR are available in our latest newsletter.

A liquidity strategy is one method by which a fund is able to meet the day-to-day withdrawal requirements of its investors. Since October 2007 and the height of the Global Financial Crisis, First Mortgage Trust has held an increased level of cash which we report on in our annual Financial Statements. This helps ensure we can repay withdrawal requests.

Yes, we do hold a reserve fund to help meet possible losses on individual loans with a very small part of the Fund’s income set aside each year and accumulated within the reserve fund. This fund provides additional peace of mind for investors and generally does not have a material effect on income distributions.

However, if there are a number of loan defaults then the reserve fund may not be enough of a buffer, and this could affect income distribution.

First Mortgage Trust Group Investment Fund is monitored by New Zealand’s oldest independent trustee company, Trustees Executors Ltd, acting under a Trust Deed.

First Mortgage PIE Trust’s supervisor is Public Trust.

Both First Mortgage Trust Group Investment Fund and the First Mortgage PIE Trust have their financial statements audited by KPMG.

Appointed supervisors add a layer of oversight, providing our investors with confidence that their money is in the best of hands and only being invested in accordance with the Trust Deed.

Debentures are a type of debt security issued by companies (mainly finance companies and large corporates) in return for investment of funds. The security for the debenture-holder is usually in the form of a general security agreement over the assets of the company issuing the debenture. With debentures, you are lending the company money on security over its assets.

By comparison, mortgage trusts have, as the underlying security for their investment, registered mortgages over land and buildings. In the case of First Mortgage Trust, these are only registered first ranking mortgages with conservative Loan to Value ratios (LVRs). They also have cash holdings.

A mortgage is a charge over physical property or land which is securing the payment of a loan. A registered first mortgage is the first charge over the property and must be repaid before any subsequent charge (e.g. a second-ranking registered mortgage).

No, the Fund itself does not pay commissions. However, the Manager may do so from its own funds and at its own discretion.

It is important to check your Prescribed Investor Rate (PIR) annually to make sure you’re paying the right amount of tax on your investment.

If your PIR is too high, any tax overpaid will be used to reduce any income tax liability you may have for the tax year and any remaining amount will either be refunded to you or held as a tax credit. Inland Revenue will notify you if you’re due a refund or a credit will appear in your myIR.

If your PIR is too low, you’ll be required to pay any tax shortfall as part of the income tax year-end process.

We may be notified by Inland Revenue to update your PIR if they believe it is incorrect. We are required to apply this updated PIR. However, you can provide us with a different PIR if you believe it is incorrect.

We recommend that investors seek professional tax advice regarding their individual circumstances, or to clarify any of the following before investing.

Individual investors

The First Mortgage PIE Trust will pay tax on an investor’s investment in the Fund at the individual investor’s notified PIR rate (either 10.5%, 17.5% or 28%) meaning income earned from the Fund will be distributed to that investor tax paid. Provided the correct tax rate is used, tax paid by the Fund on behalf of individual investors is a final tax which means that there is no requirement for the individual to include this income in their own tax return.

Visit the IRD website to work out your PIR – IRD website

Trust and company investors should speak to their professional advisers to determine their PIR.

The First Mortgage PIE Trust is a portfolio investment entity (PIE). The amount of tax you pay in respect of a PIE is based on your prescribed investor rate (PIR).

If you are unsure of your PIR, we recommend you seek professional advice or contact the Inland Revenue Department. It is your responsibility to tell First Mortgage Trust your PIR when you invest or if your PIR changes. If you do not tell us your PIR, a default rate will be applied.

If the rate applied to your PIE income is lower than your correct PIR, you will be required to pay any tax shortfall as part of the income tax year-end process. If the rate applied to your PIE income is higher than your PIR, any tax over-withheld will be used to reduce any income tax liability you may have in following years as a tax credit.

To learn more visit the IRD Website about PIEs for NZ Residents – IRD Website

Complete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.