The main benefits of investing in the PIE Trust are:

More information on this is available by clicking the button below.

Which fund is right for me?

There is no fixed term for an investment in the PIE Trust, meaning investors’ funds are normally accessible, if needed. However, we do reserve the right to charge withdrawal fees in the first two years of investment.

You can start investing with us with as little as $500.

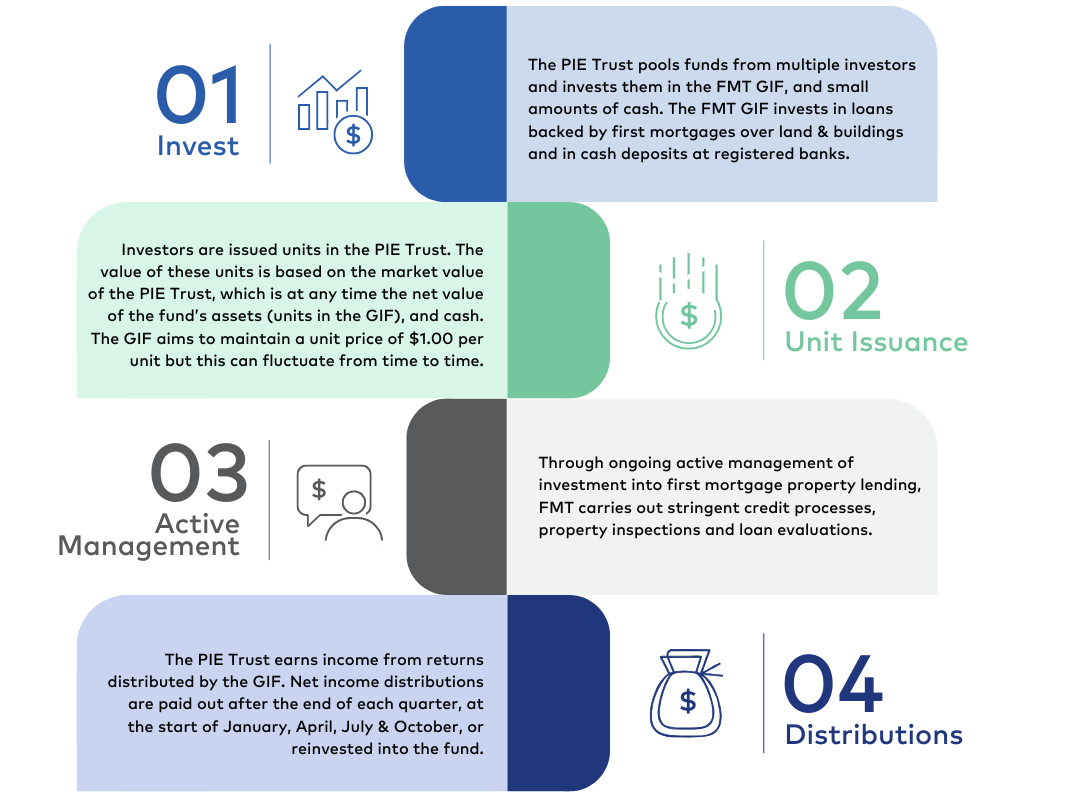

The investment objective of the PIE Trust is the same as that of the FMT GIF: To provide investors with an income return at a level which is better than bank deposits.

After each quarter, at the start of January, April, July and October, we distribute returns to our investors. They can choose to have these returns paid into their bank account or reinvested back into the fund.

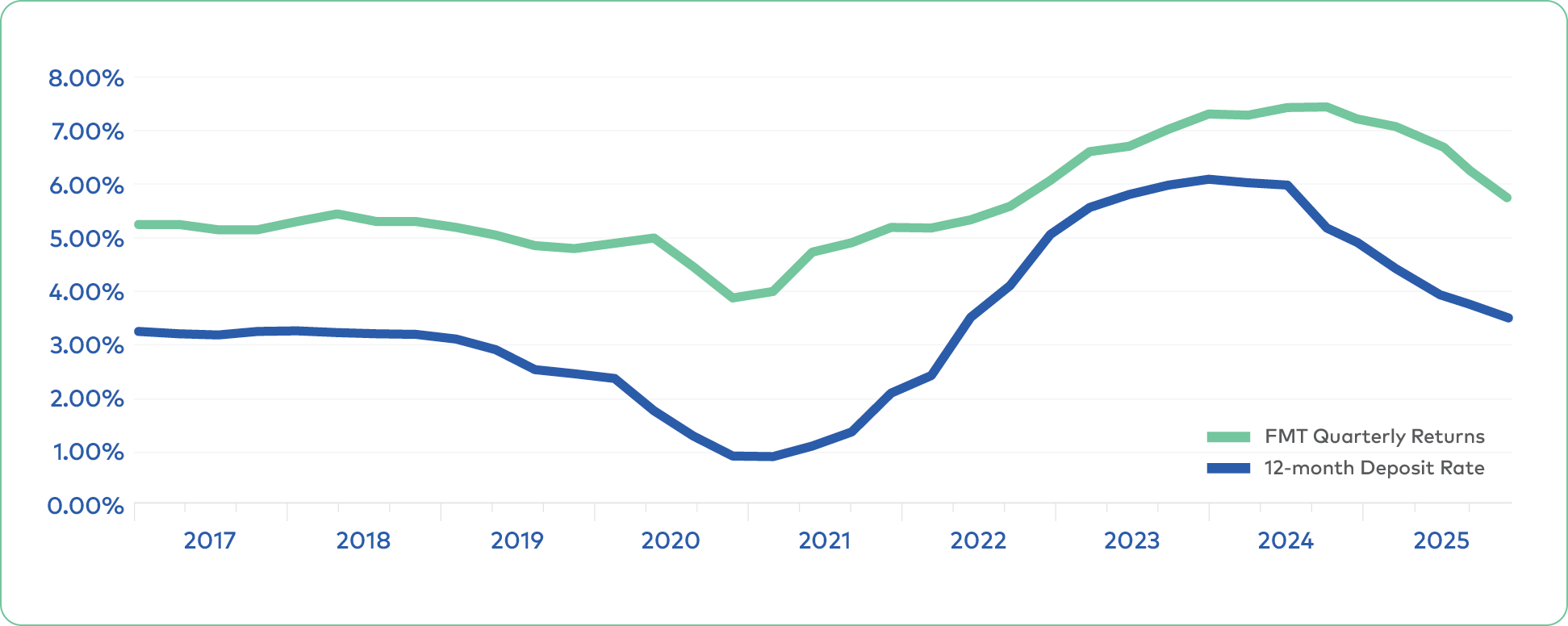

While it cannot be assured, our objective as manager of the FMT GIF is to give investors an annualised pre-tax quarterly return (after fees and expenses) of at least 1% per annum higher than the average of the 12-month term deposit rates offered by New Zealand’s four main trading banks.

The advertised quarterly rate is always before tax, but after fees (and expenses) have been deducted.

With any investment there are risks and a chance the return may be different from what is expected. The key to our success has been our conversative approach and the first mortgage investment security we require when lending (via first mortgages on New Zealand land and buildings with relatively conservative loan to valuation ratios).

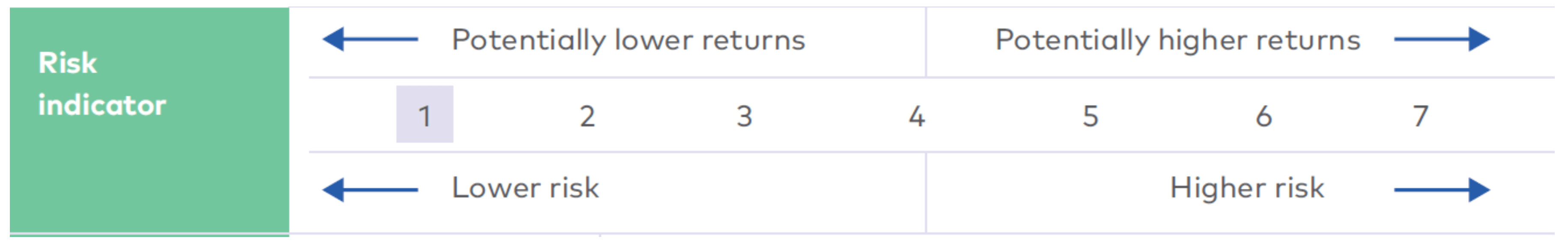

The FMT GIF currently has a risk indicator of 1, which does not mean it is a risk-free investment. For more information, please refer to the Fund’s Product Disclosure Statement.

There are no management fees for the PIE Trust. However, the FMT GIF charges are estimated at 1.65% of the Fund value including GST (if any). This is subject to change. These charges are indirectly fees of the PIE Trust and therefore affect your investment return.

We also reserve the right to charge a withdrawal fee of 2% of the amount withdrawn during the first year of investment in units and 1% of the amount withdrawn during the second year of investment. There is no withdrawal fee for investors who withdraw after their second year of investment.

There are no upfront fees when you invest with FMT.

This graph shows the historical annualised pre-tax (after fees & expenses) quarterly distribution rates for the First Mortgage Trust Group Investment Fund versus the average 12-month bank term deposit rate since 2017.

Data as at December 2025. Term Deposit data from the Reserve Bank of New Zealand (RBNZ). Past performance is not a reliable indicator of future performance. Returns are subject to change and are not guaranteed.

At FMT, we focus on protecting investor capital and providing a steady return rather than seeking higher risk, potentially higher return opportunities.

At the same time our investors get the peace of mind of knowing that their money is being invested right here in New Zealand, helping grow our local economy.

Want to learn more about how we do this? Check out some of some of the projects we have successfully funded.

View Case Studies

Get in touch with one of our friendly team, we’re always available to answer your questions and give you a hand.

Want to start investing or learn more?

You can request a copy of our Investor Pack here, either as a digital or physical brochure.

Download Request a Physical PackComplete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.