| FMT Fund | Term Deposit | |

|---|---|---|

| Institution | Fund manager specialising in property lending | Registered Bank |

| Returns | Variable, calculated quarterly | Fixed interest rate |

| Accessibility | Funds normally accessible | Normally, locked in for the fixed term |

| Distribution Frequency | Quarterly returns, these can be reinvested or paid out | Interest typically paid at maturity, or at periodic fixed intervals |

FMT: Fund manager specialising in property lending

Bank: Registered Bank

FMT: Variable, calculated quarterly

Bank: Fixed interest rate

FMT: Funds normally accessible

Bank: Locked in for the fixed term

FMT: Consistent quarterly returns, these can be reinvested or paid out

Bank: Interest typically paid at maturity, or at periodic fixed intervals

We’ve been trusted in New Zealand since 1996, offering a managed investment scheme where investor funds are pooled into a trust and invested primarily in first mortgages on New Zealand properties.

In simple terms, bank term deposits are a type of investment where someone invests a set amount of money with a bank for a nominated and agreed fixed term. Bank deposits are some of the most popular investments available to New Zealanders, and there are a number of benefits, including:

While bank term deposits can be attractive to some investors, there are a couple of factors to be aware of:

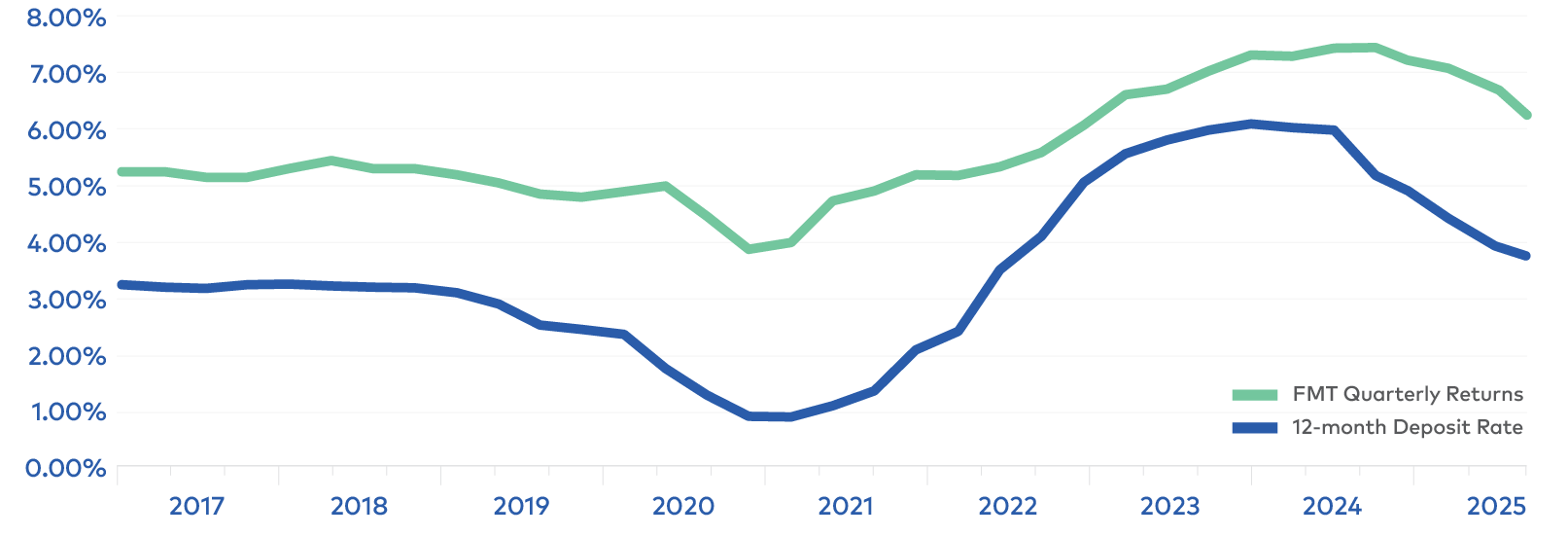

This graph shows the historical annualised pre-tax (after fees & expenses) quarterly distribution rates for the First Mortgage Trust Group Investment Fund versus the average 12-month bank term deposit rate since 2017.

Data as at 30 September 2025. Term Deposit data from the Reserve Bank of New Zealand (RBNZ). Past performance is not a reliable indicator of future performance. Returns are subject to change and are not guaranteed.

You can learn more about investing with FMT, including links to information on each fund on our investing overview page.

Learn MoreFor a more detailed information you can download an investment brochure, or request an investment pack, which contains the Product Disclosure Statements for our funds and more information.

Investor Brochure Investment PackComplete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.