We focus on what we know is important to you; consistent returns and steady income-focused funds that are accessible when they’re needed.Use our calculator to work out what your returns could have been over the past 12 months if you had invested with FMT.

This calculator uses our historical returns to calculate returns for the 12 months prior to the 31 December 2025, based on a given investment amount and tax rate. Past performance is not a reliable indicator of future performance, and returns are not guaranteed. Future performance could vary significantly from past returns.

In an era of economic volatility and market uncertainty, investment opportunities that provide consistent returns can be hard to come by.

FMT has managed to achieve this for 30 years.

We aim to provide an income return at a level better than bank deposits.

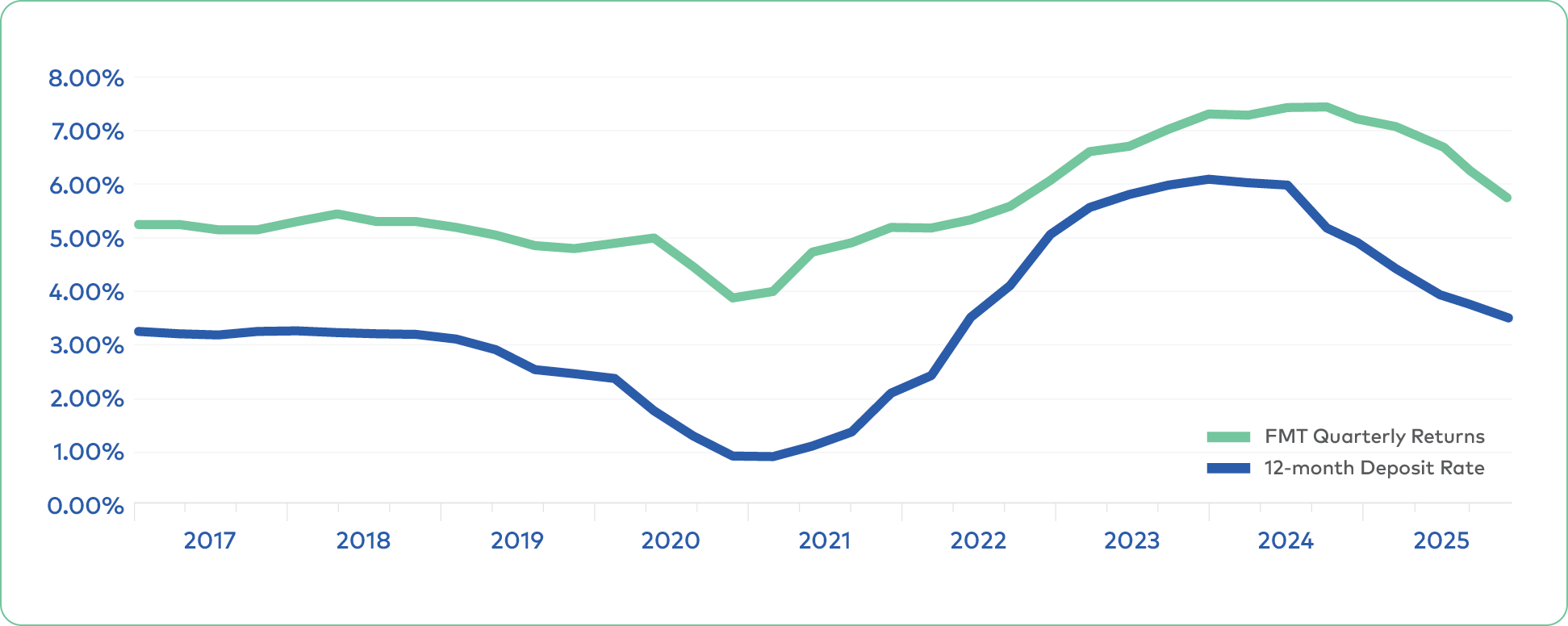

While it cannot be assured, our goal is to give investors an annualised pre-tax quarterly return (after fees and expenses) of at least 1% per annum higher than the average of the 12-month term deposit rates offered by New Zealand’s four main trading banks.

This graph shows the historical annualised pre-tax (after fees & expenses) quarterly distribution rates for the First Mortgage Trust Group Investment Fund versus the average 12-month bank term deposit rate since 2017.

Data as at December 2025. Term Deposit data from the Reserve Bank of New Zealand (RBNZ). Past performance is not a reliable indicator of future performance. Returns are subject to change and are not guaranteed.

Your investment is not made for any fixed term and can normally be withdrawn at any time.

We do encourage you to invest for a minimum of 2 years, as this aligns with the usual term of the property loans that earn your returns, and we reserve the right to charge withdrawal fees in the first two years.

Learn More

Every quarter, we distribute returns into your bank account, or you can choose to have them reinvested back into the fund. You tell us your preference, and we do the rest.

You can start with a minimum of $500 and after that you can make further contributions at any time that suits you (minimum $100 additional investment).

Ready to take the next step?

Although past performance is not a reliable indicator of future performance, in almost 30 years the FMT GIF has never lost a cent of investor capital or missed paying a quarterly return payment to investors.

Learn MoreThere may be tax benefits to investing in a PIE trust fund for some investors, which means that some investors can get the best of both worlds – consistent returns from the FMT GIF and an advantageous tax rate.

Learn MoreComplete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.