The FMT Wholesale Fund invests in units in the FMT GIF, and cash.

The investment objective of the FMT GIF is to provide investors with an income return at a level which is better than bank deposits.

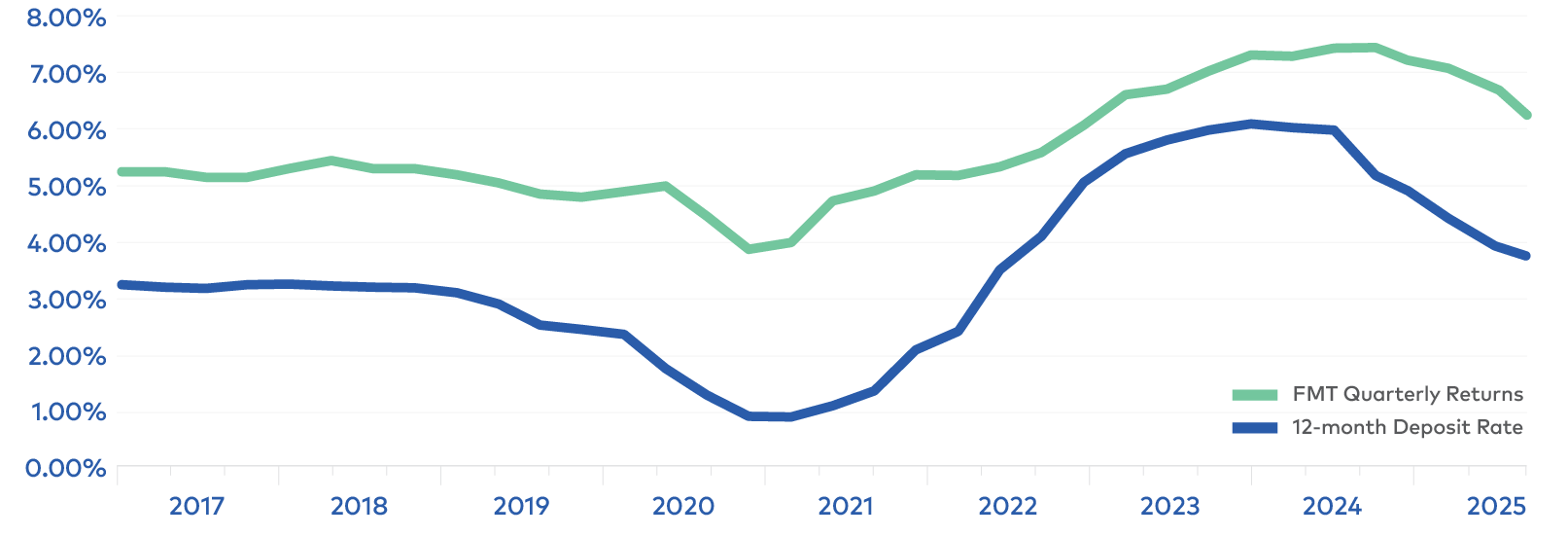

While this cannot be assured, First Mortgage Managers Limited’s (FMML) objective is to give investors an annualised pre-tax quarterly return (after fees and expenses) of at least 1% per annum higher than the average of the 12-month term deposit rates offered by New Zealand’s four main trading banks, and competitive with comparable investments.

In return for investing $500,000 or more in the FMT Wholesale Fund for a term of at least two years, FMML will give wholesale investors a bonus return (by way of issuing additional units in the FMT Wholesale Fund which are paid for out of FMML’s own funds), in addition to the quarterly distribution of income.

Net income distributions are paid out to investors quarterly at the end of March, June, September and December, or reinvested into the fund. PIE tax is deducted from distributions if relevant.

This investment is only available for wholesale investors.

The FMT Wholesale Fund requires a minimum investment of $500,000 for a minimum term of two years.

The investment is managed by FMML which is a licensed manager of retail schemes under the Financial Markets Conduct Act. While the FMT Wholesale Fund is not a retail scheme, it invests in the FMT GIF which is a managed investment scheme which is registered under the Financial Markets Conduct Act.

This graph shows the historical annualised pre-tax (after fees & expenses) quarterly distribution rates for the First Mortgage Trust Group Investment Fund versus the average 12-month bank term deposit rate since 2017.

Data as at December 2025. Term Deposit data from the Reserve Bank of New Zealand (RBNZ). Past performance is not a reliable indicator of future performance. Returns are subject to change and are not guaranteed.

At FMT, we focus on protecting investor capital and providing a steady return rather than seeking higher risk, potentially higher return opportunities.

We’ve never lost a cent of investor capital in almost 30 years of operations. And while past performance is not a reliable indicator of future performance, this is something that we’re very proud of, and that we’re committed to maintaining.

Please fill out the form below to request a copy of the FMT Wholesale Investment Memorandum.

We will email it to you shortly after you submit the form.

This offer by First Mortgage Managers Limited is limited to persons who are wholesale investors for the purposes of the offer in terms of clause 3(2) or 3(3)(a) of Schedule 1 of the Financial Markets Conduct Act 2013. No Product Disclosure Statement for the purposes of that Act has been prepared and none is required for a wholesale offer. Climate statements are also not required in respect of this fund. The Wholesale Investment Memorandum is available on request.

Complete this questionnaire to see what type of fund might be the most tax effective for your circumstances. Please note, this is just a guide and we recommend you seek professional tax advice.

Disclaimer – This tool is intended to provide general guidance only. This tool does not take into account your particular financial situation, objectives or goals.

There are alternative strategies which may provide better outcomes, we recommend you seek independent advice before making any investment decision. If you have completed this guide and wish to discuss this, we recommend you seek professional tax advice.